American household debt hits a 15-year high of $17 trillion

🏚️ American household debt hits a 15-year high of $17 trillion.

Spiraling towards levels only seen during the 2008 financial crisis, US household debt has increased by $320 billion in the last 3 months of 2022. The average American household owed $142,680 at the closing of the year, signaling that the economy cannot take any more blows. The average credit card annual percentage rate has reached 19.14% - beating the last record set in July of 1991 at 19%.

A recent report highlights the success of reshoring initiatives, leading companies to scramble to find manufacturing operations in the United States and Mexico.

These results are somewhat surprising, considering many of those same individuals are interested in the technology that powers those systems.

China currently dominates the rare earth and mineral production market, controlling the lion’s share of 60% globally.

It’s a strange conundrum, indeed. Economists are scratching their heads at a 3.4% unemployment rate while the rest of the economy teeters on the edge.

The Biden Administration is considering extending the Trump-era tariffs which account for hundreds of billions of dollars in levies - and some businesses don’t like that.

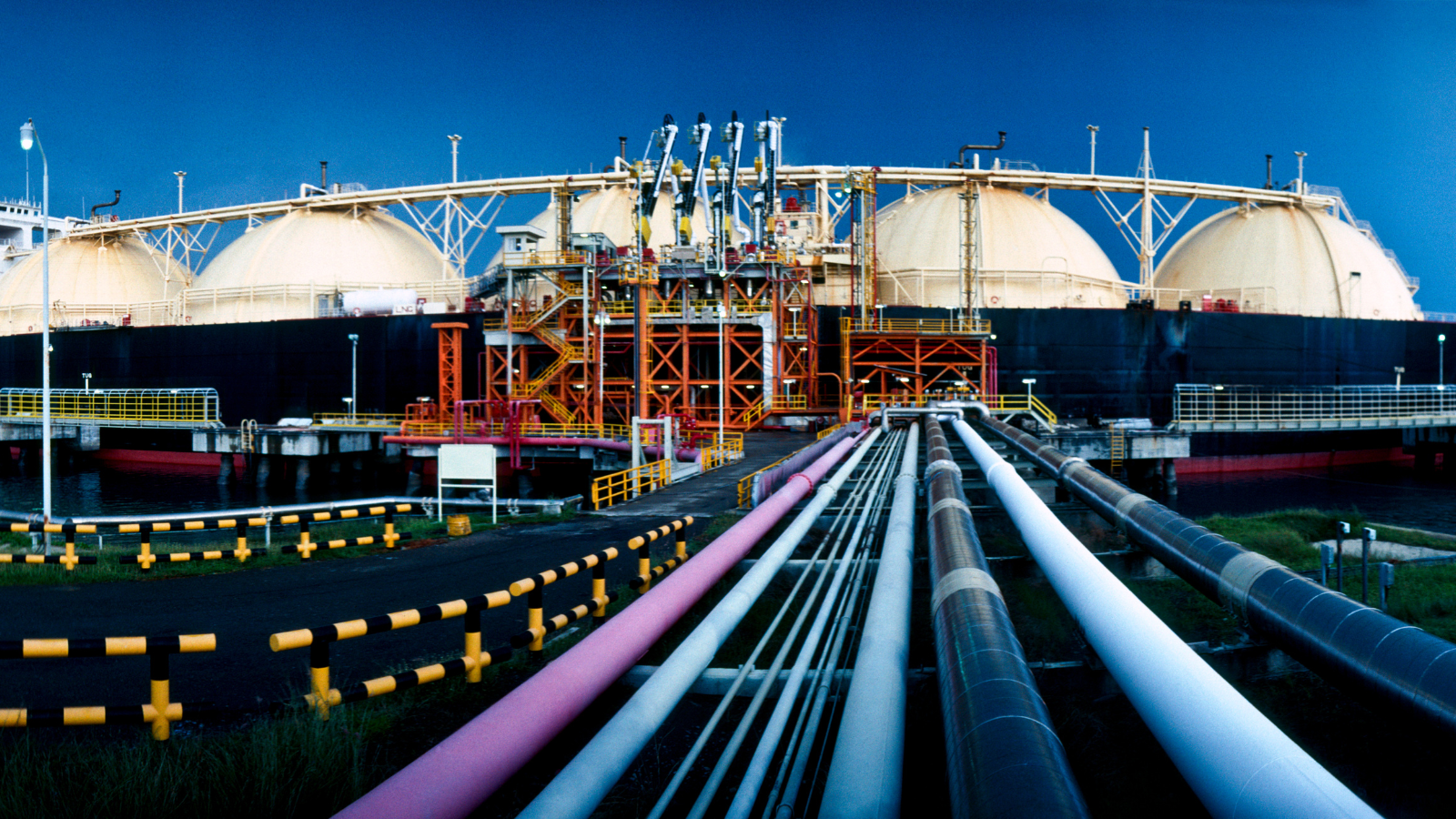

LNG stands for liquefied natural gas, a form of natural gas that has been cooled to a liquid state, making it easier to store and transport.

While the relationship between the two countries is critical, United States officials are vocalizing angry sentiments at the Saudi-led OPEC decision to cut oil production.

Wealthy American families are increasingly obtaining second, or even multiple, citizenships and residences, a trend highlighted by Henley & Partners, a law firm specializing in high-net-worth citizenships.