Industry Indicators: July 17-24

Industry Indicators: July 17 - July 24

iLevel Logistics presents intriguing data that offers a snapshot of notable industry changes and events during the week of July 17th through July 24th.

Moving Violations, Contract and Spot Markets, Costs of Shipping from China, Diesel Fuel Prices, Class 8 Orders, Bridge Conditions, Detention and Demurrage Costs, Crop Shipping Costs, LMI Index, Warehouse Rents, Buy Big Online, Off-Site Audits, New For-Hire Trucking Companies, Trailer Orders, Driver Shortage Forecasted, Owner-Operators preferred Compensation Method, Domestic Freight Expenditures

Moving violations issued to truckers

Source: OverDrive

US truckload freight contract and spot markets nearing parity

Source: Supply Chain News

Costs of Shipping from China – in perspective

Source: Logistics Management

More Shipping Rates – in historical context

Source: AJOT

Diesel Fuel Prices Up Across Nation – U.S. $3.44

Source: EIA

Class 8 Truck orders in June – 27,700 units up 13% from May

Source: HDT

Top 10 States – highest % of Bridges in Poor Condition

Source: OverDrive

Detention and Demurrage significantly more costly in 2021

Source: SupplyChainDive

Average combined demurrage and detention charge across shipping lines and container types after 2 weeks in USD, import and export combined.

Crop Shipping Costs Surging

Source: Reuters

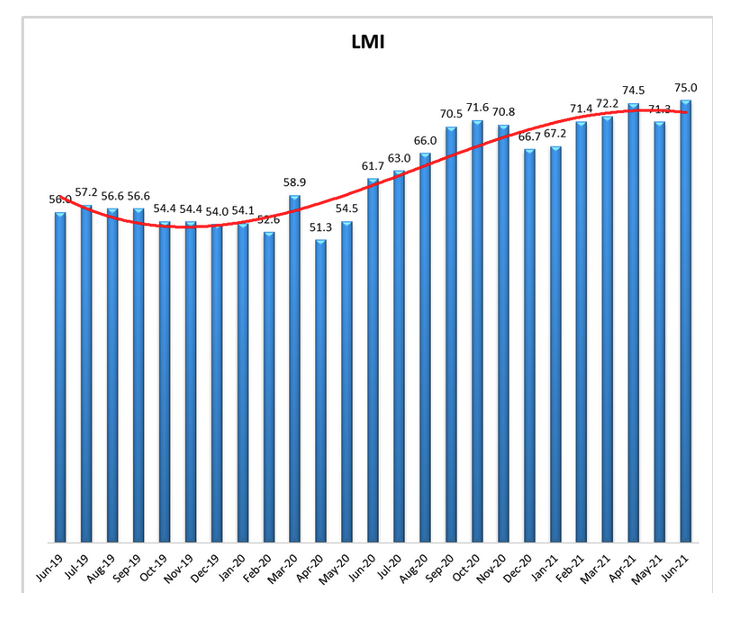

Logistics Industry growth Continues – spurred by demand for warehousing and transportation – Logistics Manager’s Index climates reaches second highest reading.

Source: DC Velocity

Transportation and warehouse capacity tight - while Inventory costs increase:

“Essentially, the changes to logistics demand over the last year mean that it has become significantly more expensive for supply chains to hold and move each unit of inventory, even in cases where they have less inventory than they did before. This will continue until supply chain networks, which are still configured for pre-pandemic business cycles, can be adjusted to better reflect our post-pandemic reality.”

Warehouse rents increase from 2021 Q1 to Q2 – vacancy rates hits record low of 4.5% in Q2

Source: SupplyChainDive

Consumers say they will continue to buy big online

Source: Reuters

COVID increases offsite audits

Source: HDT Trucking Info

New for-hire trucking companies increase notably in late 2020 and into 2021

Source: OverDrive

Yet, with chip shortage, production of Class 8 trucks drops.

Trailer orders beginning to recover from 2020 rollercoaster

Source: Fleetowner

Driver Shortage Forecasted to be 160,000 by 2028

Source: Transport Topics

Percentage of load/revenue most preferred by owner-operators

Source: OverDrive

Freight Shipping Expenditures Reach All-Time High

Source: SupplyChainDive

The dollars spent on domestic trucking shipments attained record levels in 2021 Q2 – according to U.S. Bank Freight Payment Index. Q2 index increased 10.1% from Q1 to 233.6. U.S. Bank noted,

“These robust gains stem from extremely tight truck capacity due to a profound driver shortage, as motor carriers have been unable to increase supply sufficiently to meet the growing demand.”

That’s it for this week, thanks for reading!

To sign up for our free Daily readings click here