Five Graphics Representing the 2021 Supply Chains

The Ever Given

On March 23, 2021, a skyscraper-sized ship wedged itself sideways into the banks of one of the world’s busiest and economically important waterways. It blocked the canal for 6 days.

The 1,312-foot, 220,000-ton ship, nearly a quarter mile in length, attracted worldwide attention and captured the public’s imagination. It also caused a massive traffic jam of more than 360 ships costing billions in delayed shipments. In addition, many other vessels had to alter course which added weeks to their destinations.

The impact reverberated across the world’s supply chains. Approximately 12% of global trade flows through the Suez Canal on ships like the Ever Given. Lloyd’s List estimated that more than $9 billion worth of goods move across the waterway daily, which converts into about $400 million an hour. A six-day stoppage therefore impacted the entire supply chain, causing congestion and disruption in every port and delays for every vessel that depend on the Canal’s efficiency.

Stephen Flynn, founding director at the Global Resilience Institute, noted “you’ve essentially created this traffic jam that doesn’t allow you just to reset and restart – you have to restack and reset the system and that’s something that’s going to take a lot of choreography.”

Turns out, the Ever Given’s trouble would be a harbinger for several supply chain nightmares in 2021.

image: gCaptain

Retail Sales

Three massive government relief packages in 2020 an early 2021, combined with the Federal Reserve’s easy money policies, drove this year’s retail sales well above pre-pandemic trends. In just 15 months, retail sales in fact surged 22% above pre-pandemic levels. That increase was more than the sales growth in the previous 5 years combined!

The chart shows the extraordinary excess demand (the difference between pre-covid trend line and actual retail sales) generated by the government stimulus programs. Surging consumer demand coupled with supply chain shortages laid the foundation for the classic definition of inflation; too much money chasing too few goods.

Source: iLeveL Logistics

Inflation

Everywhere you looked prices rose in 2021. From the gas pump to the grocery store, consumers confronted significantly higher prices than the previous year. Here’s a breakdown from the December CPI report.

Fuel oil: +59.3%

Gasoline: +58.1%

Used Cars: +31.4%

Gas Utilities: +25.1%

Meat/Fish/Poultry/Eggs +12.8%

New Cars: +11.1%

Overall CPI: + 6.8%

The evidence for inflation was evident throughout 2021. For example, at the start of the year, inflation registered a modest 1.4%. But thereafter the CPI climbed at an alarming rate. By November, year-over-year change reached 6.8%. This is the highest percent change since 1982.

Nevertheless, US Federal Reserve chairman Jerome Powell held firm, repeatedly saying,

“We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances.”

Source: FRED Economic Data

Job Quits

An additional factor that impacted the supply chain - and therefore prices, was the percentage of workers who quit their jobs. The so-called Great Resignation peaked at an all-time high of 3.0% in November, which matched the previous record in September.

Workers quit their jobs for several reasons. First, and most important, in 2021 there were more jobs available. A recent iLevel analyses demonstrated a strong association between job quits and job openings. In other words, workers are rational. When jobs are plentiful, they quit and seek more favorable opportunities. When job prospects are dim, they stay.

Second, three rounds of stimulus checks produced substantial personal saving. This in turn offered workers the financial security to leave jobs they did not like and pursue the ones they did. It also added significant pressure on firms to increase pay and benefits to retain workers – which many larger firms did including Amazon, Walmart, Costco, McDonald’s, Starbucks, and Bank of America. To offset the higher labor costs, most companies chose to pass costs to the end consumer – adding to inflationary pressures.

Finally, an extensive iLevel analyses showed that many workers quit their jobs to form businesses. Business formations sky rocked in 2021 – and in 2020. It appears as if the Great Resignation unleased an enormous and sustained grassroots entrepreneurship – otherwise known as the Great Rejuvenation.

Source: iLeveL Logistics

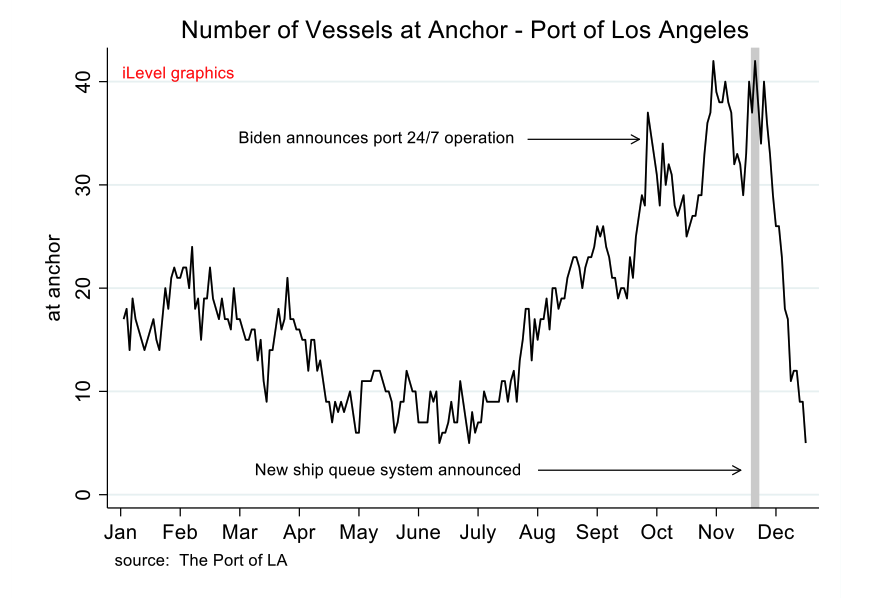

California Ports

Extraordinary consumer demand and pandemic induced disruptions conspired to produce a Suez Canal size calamity for the California ports. The major shipping ports of LA and Long Beach made news for massive congestion and persistent bottlenecks. Like the troubles at the Suez Canal, disruptions in California ports impacted the entire supply-chain, slowing deliveries across the country and contributing to surging inflation.

Dozens of massive cargo ships drifting in San Pedro Bay waiting for weeks to unload became the most visible symbols of the nation’s besieged supply chains. Widespread media attention to logistics management followed (even drawing scrutiny from 60 minutes) and President Biden issued an executive order directing federal agencies to address supply chain difficulties. Later, Biden would negotiate several agreements with port authorities to enhance efficiencies.

However, nothing seemed to work. From summer to late fall, the number of vessels lingering in the waters offshore increased, peaking in mid-November at more than 40 ships. Frustrated, port authorities settled on a clever new queueing policy that dramatically reduced the number of ships in the harbor. While the total number of ships waiting to unload stayed about the same, the new policy moved the waiting line farther out to sea. Ships miles out could not be classified as physically at anchor. They also could not be seen from shore. However, those ships were still in line, waiting to deliver their cargo.

The policy thus simply lengthened the wait line and removed the unwanted images of delayed ships in the harbor. While average wait times continue to climb, ships must now wait miles out at sea – out of sight, out of mind.

These 5 graphics represent key aspects of the 2021 supply chain story. And it was an extraordinarily important story in 2021. Last year should in fact be recognized as the year of the supply chain.

Supply chains made headlines daily. They were regularly featured on the nightly news. And they became a persistent concern for local, state, and national political figures. From an obscure, private sector issue to the national spotlight, supply chains in 2021 engaged nearly everyone.

Happy New Years from iLevel Logistics!

We wish you all a happy, healthy, and prosperous 2022. If we can help you on your path, please reach out. And of course, sign up with your email address to receive free news, updates, and exclusive content from Road Scholar.

The Workday Dash is an aggregation of articles regarding the transportation logistics, trucking, and supply chain industries for April 15, 2025, from iLevel Logistics Inc.