8 Graphs you Need To See: August 3, 2022

Nominal versus Real 💸

These two charts from @WSJ offer important reminders to separate nominal and real indicators – especially during high inflation periods. The first graph on US disposable personal income is a familiar one. Current dollars greatly exaggerate real inflation-adjusted dollars.

The second graph illustrates the same phenomenon but applied to retail sales figures. Many analysts point optimistically to increasing retail sales, leaving the impression of strong retail demand. However, with prices exploding, much of the increase is simply due to high inflation. When adjusting for that reality, retail sales are dropping - notably.

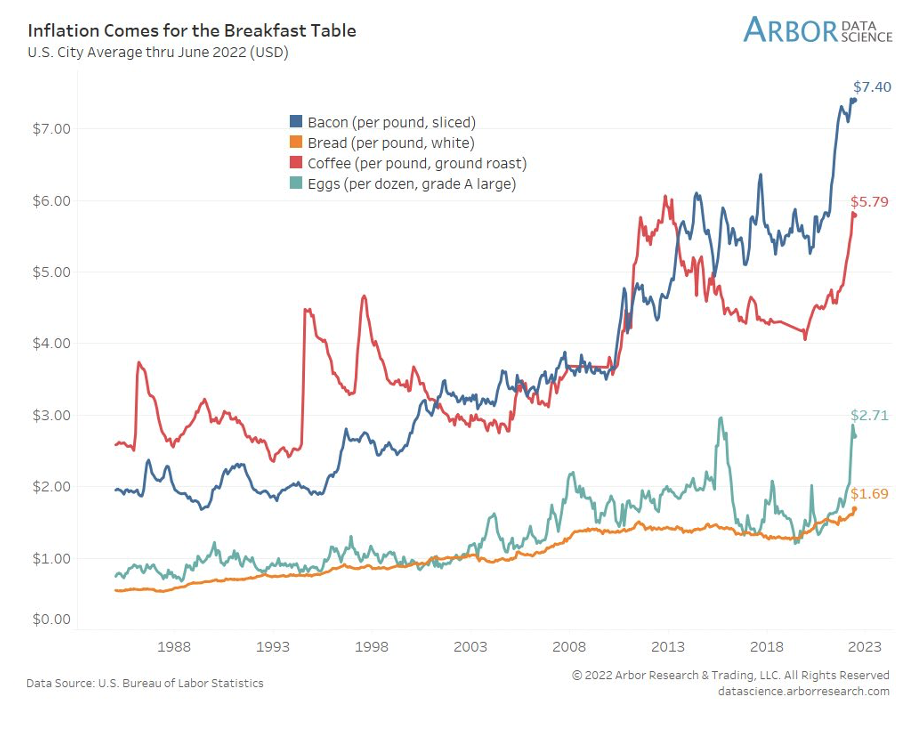

Inflation for breakfast 🍳

Speaking of inflation, the cost of basic breakfast items is spiking. In particular, check out the bacon and coffee spikes, and the recent increase in eggs.

The abortion divide ⚖️

The next graph illustrates political divisions or affective polarization on abortion. In the 1980s, the political parties (individuals identifying with the parties) were nearly in agreement about abortion. However, by the early 1990s, the split began and then widened considerably by 2000. Now, the divide is the largest recorded. Most Democrats believe abortion should be legal under any circumstances while most Republicans disagree. About a third of Independents agree that abortion should be legal under any circumstances.

Consumer savings – and likely consumer debt 💰

A reality check on consumer savings @LendingClub. A total of 15.4% of households have zero savings! More than half of households have less than $5,000 saved. Bloomberg reported that 13% of households spent more than they earned in the past six months.

Historical inflation is forcing many consumers to load up on credit cards to help pay for everyday expenses. In short, poor saving rates, combined with rising prices, mean US consumer borrowing will undoubtedly increase in the months ahead.

Here is another way of looking at consumer savings. Recall, that we hear a lot about how much Americans saved during the pandemic. Notice, in the graph below, the unprecedented spike in US personal saving as a % of disposable income during the pandemic. However, now, personal savings as % of disposable income rests at its lowest point (5.1%) since August 2009. The post-pandemic binge is depleting savings – and quickly.

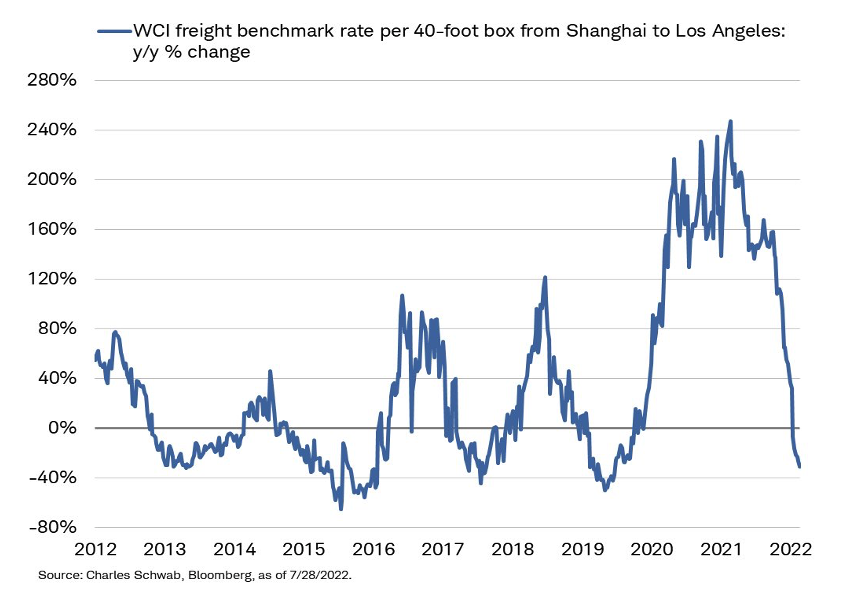

Shipping costs declining! 📉

Here is some positive news about shipping costs. Year over year changes in the cost to ship 40ft containers from Shanghai to Los Angeles dropped to the lowest levels since the start of the pandemic (-32%). While prices are still elevated, Y/Y changes are certainly moving in the right direction.

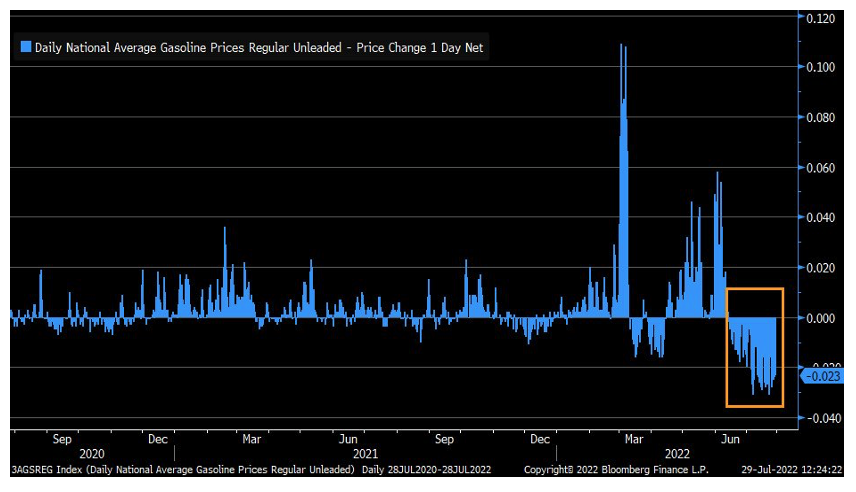

Gas prices dropping! ⛽️

And in another good piece of news, average gasoline prices have not increased daily since mid-June.

Valentine's Day is a holiday filled with love, flowers, and lots of chocolate. Let's take a look at this graphic showing just how much goes into Cupid's Birthday every single year.

The blockchain isn’t just that weirdly-named coin that your uncle raved about at the Thanksgiving dinner table.

In a world where being eco-conscious is more important than ever, the transportation game is stepping up its green game.

What are the future trends in logistics? Let's chat about what's cooking in the world of transportation.

Let's face it, the world can be a pretty wild place. Every now and then, global events come along that significantly throw us off-balance - especially in the way everything gets made and shipped.

So, you're in the logistics game, and you know that keeping your customers happy is an absolute must. But how do you figure out if you're actually succeeding at customer service?

Navigating the logistics world can sometimes feel like a unique challenge... but trust me, you've got the skills and determination to make some waves in this industry.

In the hustle and bustle of the logistics world, we all know how vital it is to get things right - and hopefully, the first time. Whether it be getting that package to your doorstep on time or making sure goods reach stores and factories without a hitch. But here’s the real question: how do we keep the tech advancements and good ol’ human touch in perfect harmony in this ever-changing industry?

Whether you're new to the industry or want to step up your game, let’s map out your journey to becoming a first-rate logistics leader while on the move.

Navigating the Current: Inflated Fuel, Wage Woes, and Biden's Approval Slides in the Era of Love in Cyberspace, Fueling Relief, and Charging Ahead with Car Costs and Senior Surge, All Against the Backdrop of Inflated Timelines and Charged Distances.

In the world of logistics, where every second counts and every mile matters, technology is rewriting the rules of the game.

Transportation executives, industry observers, and local politicians nodded approvingly and wholeheartedly welcomed the federal largess. After all, the Bipartisan Infrastructure Bill was a once-in-a-generation investment in the country’s logistics infrastructure. The legislation was long overdue and could help reset the supply-chain mess that caused so much havoc during the pandemic.

Explore the dynamic landscape of today's economy with a visual journey through key trends and data points. From plummeting gasoline prices to intriguing shifts in job openings and consumer sentiment, our collection of graphs and visuals offers an engaging perspective on the economic forces at play.

Explore the latest updates on politics, economics, demographics, and more in our informative blog post. Discover insights into crucial topics such as election dynamics, financial trends, population changes, and public opinion. Stay informed with our in-depth analysis of the issues shaping our world today.

Let’s dive deep into various aspects of the current economic landscape, supported by informative graphs and visuals. From auto owners' struggles with loan payments to the dramatic shifts in global container freight rates, we provide a visual overview of key trends affecting our economy.

Explore Key Trends: Job Declines, Imports Surge, Housing Challenges, Sports Trends, and More in Our Latest Post. Stay Informed!

In the run-up to party nominations, the media delves into horserace analyses, fixated on determining who's leading and who's lagging in the campaign landscape. Trump basks in a substantial lead among Republican contenders, while Biden stands uncontested among Democrats.

Explore the South Coast Air Quality Management District's (AQMD) groundbreaking Indirect Source Rule (ISR) mandate, targeting air quality concerns in Southern California's warehouses. Discover the multifaceted impact on the supply chain industry, as we delve into the advantages and drawbacks of the AQMD ISR mandate.

In our latest blog post, we've compiled a series of informative graphs and visuals that shed light on some crucial economic and societal trends. Let's take a glimpse at some of the key highlights.

In recent years, the push for sustainability and carbon footprint reduction in the transportation industry has intensified. A noteworthy development in this pursuit is the shift from conventional diesel-powered Class 8 trucks to electric power. Advocates of this transition tout its potential for a cleaner environment, reduced operating costs, and heightened energy efficiency. Yet, it is imperative to scrutinize the associated challenges and potential pitfalls.

We're diving deep into a dynamic landscape of economic trends and public sentiments: EV Adoption, Driver Behavior, National Debt, & more.

As inflation continues to make headlines, the impact on public perception and policy remains a critical concern. In this analysis, we delve into the intricacies of inflation reporting, exploring how the Consumer Price Index (CPI) serves as a key metric.

This post delves into various important topics, from nearshoring in supply chains to the 2024 election and economic indicators. Discover the latest insights and trends shaping our world.

Check some of the latest graphics around the web: A series of charts, diagrams, and visual representations showcasing billionaire rankings, transportation employment statistics, mineral demand for EVs, and credit card debt trends.

Let’s delve into the latest U.S. trends: Inflation, Emissions, Consumer Habits, and Hollywood’s Comeback.

In the world of ESG investing, the focus has long been on divesting from brown firms and embracing green ones. However, this conventional approach may not be the most effective way to combat climate change and promote sustainability.

From an in-depth analysis of falling Asian exports to the notable rise in cargo volumes at the Port of Los Angeles to the growing demand for used Teslas. Gain valuable insights into these market shifts and their implications in these comprehensive graphs.

Discover the rising representation of women in the supply chain workforce, top private employers in each state, wealth migration patterns, public confidence levels, energy preferences, air travel recovery, economic growth comparisons, and the latest updates on the job market.

From the impact of the pandemic to the (nearly amusing) rivalry between tech giants… let’s explore the latest trends and developments shaping our world.

Manifest 2024 served as a reminder of the immense potential that lies ahead in the realm of supply chain technology.