Trucking Capacity, Ports, & Interest Rates: Chill out, please!

Demand surges and businesses rush in to capitalize. Demand slows and businesses pull back. This is normal market dynamics.

However, there was nothing normal about the pandemic market. Government shutdowns produced instant and widespread unemployment, resulting in a harsh economic contraction. To offset the damage, the federal government primed consumer demand – releasing billions directly to sheltered citizens and shuttered businesses. Like a water faucet, the economy was turned off and then turned on.

Economic whiplash.

Meanwhile, businesses let go thousands of workers and then hired thousands more. Predictably, the job market has been slow to recover.

Based on their best expectations, businesses withdrew and then invested, held steady, then jumped in. But their decision calculus had no precedent. The business community witnessed extraordinary government interventions and could scarcely foresee the next moves of state and federal governments.

The consequences of this uncertainty, the rapid start-and-stop, push-and-pull, are still emerging.

Let’s take a look at the consequences for trucking, West-coast ports, and housing.

Amid less demand, more tractors and more fleets

The other day, Graig Fuller from Freight Waves, examining this chart tweeted, “Where did all this trucking capacity come from?” Indeed, look at the impressive rise in the number of tractors for interstate-for-hire fleets. Importantly, notice the marked increase in tractor counts beginning in the summer of 2020.

The next figure shows a dramatic rise in new fleets. Fleet numbers doubled over the past five years! Again, notice the ascent after March 2020.

In retrospect, the expanded capacity appears ill-timed.

Buoyed by consumer demand and much of it due to government spending… fleets eagerly invested in additional capacity. After all, eCommerce exploded, imports reached historical levels, and interest rates remained near zero. The future looked bright.

Inevitably, though, inflation developed, and then it escalated. Once the Federal Reserve acted consumer demand slowed. As a result, freight rates dropped – and will continue to drop. What looked like a wise investment in capacity now seems impulsive.

Fleets reacted typically to an atypical freight market. Perhaps most fleets can shed excess capacity and come out ahead. Yet some fleets probably wish they had been more prudent – not reacted so quickly to the unusual pandemic market.

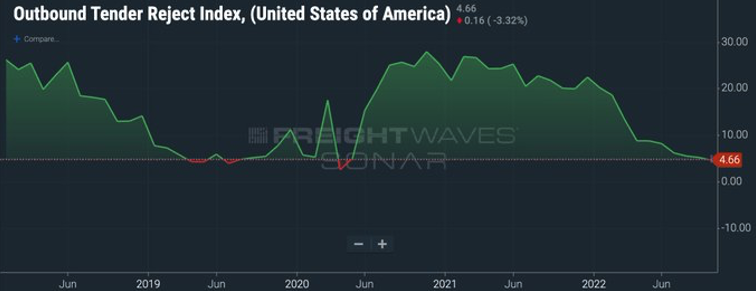

Fleets are facing challenging times. Fuller makes this clear with the Freight Waves tender rejection index – which reflects supply and demand in the truckload market. A high rejection is good for carriers, low rejection is bad. Today, rejection stands at a grim 4.66%. Only twice before was it lower than this – in early 2020 (COVID) and during the 2019 trucking decline.

West coast waiting – no more

As the economy slows, and imports fall, west coast ship queues are disappearing.

The vanishing queues support the theory that unprecedented consumer demand created the port problems – not weak or inadequate supply chains.

Given reasonable demand spikes, supply chains work well. However, no supply chain could conceivably accommodate the super-charged pandemic demand. Historically low-interest rates and several massive stimulus packages tested every link in the chain. Inevitably, some failed.

Instead of treating pandemic demand as an outlier, a 2-year peak season on steroids, the federal government and transportation businesses doubled down – see trucking capacity above. The government pumped billions more into the port and road infrastructure to construct a ‘resilient’ supply chain: A supply chain that can flex to extraordinary demand conditions. However, an obvious question looms: Are we likely to experience such conditions again?

While road, port, and bridge improvements are welcome and needed, the government’s current monetary policy is crushing demand. Gene Seroka will certainly enjoy greater capacity… But there will be precious few ships to attend?

For nearly 3 years, business leaders, elected officials, and average Americans blamed the humble supply chain. Whom will they blame now? Consumers, workers, unions, Amazon? Perhaps Vladimir Putin’s War?

The Fed was too late, and now too aggressive

Many consider the Federal Reserve’s interest rate hikes ineffective. They urge stronger measures. Recall, only months earlier most policymakers were claiming inflation was transitory and the Fed should do nothing.

The Fed did nothing.

And when it finally raised rates, it was much too late. Now, it appears to be overreacting – hiking rates further and faster than at any time in modern history.

Witness the impact on housing. Thirty-year mortgage rates are at a 20-year high and will climb still higher in the coming months. Examine how quickly rates moved from 2.5% to nearly 7%. It sure looks like panic.

The signs all point in the same direction – excess trucking capacity, unobstructed West coast ports, depressed tender rejections, flat consumer demand, surging interest rates, sky-high mortgage rates, and a troublesome stock market. It’s a rough road ahead.

The past 3 years showed that decision-makers overreacted – businesses and governments. And the whiplash continues.

Let’s hope the decision-makers can chill out, take a breath, and slow the pace of change.

Manifest 2024 served as a reminder of the immense potential that lies ahead in the realm of supply chain technology.